Diagnosing Product-Market Fit: The Five Dimensions

- Chris Hug

- Oct 21, 2025

- 8 min read

Updated: Dec 14, 2025

When revenue declines, sales blame the product. Product blames marketing. Marketing blames sales. Everyone has a different theory about what's broken. Nobody agrees on where to act.

This is the product-market fit diagnosis problem.

The issue isn't a lack of effort. The issue is a lack of a shared framework. Without one, teams talk past each other while the problem compounds.

This is the second of three related posts in our Complete Guide to Measuring Product-Market Fit.

In Part 1, you read about the 5 stages of PMF strength. Here, you'll see the 5 dimensions where fit can weaken, how to diagnose which dimension needs attention, and which team owns each fix.

At-a-glance

The problem:

When PMF weakens, every team has a different theory

Without a shared diagnosis, you fix the wrong things

By the time everyone agrees, you've lost months

The 5 dimensions:

Customer (who you serve) → Product + Sales own it

Offering (what you deliver) → Product + Engineering own it

Story (how you communicate value) → Marketing + Sales own it

Channel (how customers discover and buy) → Sales + Marketing + Partnerships own it

Company (how you execute and deliver) → CEO + Leadership own it

How it works:

Signals weaken in one or more dimensions

Dimension diagnosis shows where to act

Clear ownership means teams know who fixes it

This series:

Part 1 How to Measure Product-Market Fit: Getting Started: Understand the 5 stages of PMF strength

Part 3 Implementation Guide: Self-assessment and tracking systems

Diagnosing PMF can feel overwhelming, that's why we built our system to solve the complexity.

From 8 signals to 5 actionable areas

Product-market fit isn't a single thing. It's a system across teams. Tangible factors (product features, pricing, channel access) and intangible factors (positioning, customer perception, team capability) all interact.

Measuring PMF along a single axis misses the full picture. Strong retention but weak demand generation. Strong demand but weak delivery capability. The right product for the wrong customer segment.

That's why we created powerful tools, each strengthening PMF on its own. Our diagnosis system then tracks eight signal categories (Adoption, Retention, Demand, Value & Proof, Persona Fit, Competitive Pressure, Market Attractiveness, Risk Severity) but compress them into five dimensions.

Signals provide precision. Dimensions provide clarity on who acts. Tools close the gap.

How signals become dimensions

Our PMF System uses weighted formulas to map eight signals to five dimensions:

Customer Dimension = (Persona Fit × 60%) + (Adoption × 20%) + (Retention × 20%)

Offering Dimension = (Retention × 40%) + (Adoption × 30%) + (Value & Proof × 30%)

Story Dimension = (Demand × 50%) + (Value & Proof × 30%) + (Competitive Pressure × 20%)

Channel Dimension = (Demand × 50%) + (Market Attractiveness × 40%) + (Competitive Pressure × 10%)

Company Dimension = (Risk inverted × 50%) + (Retention × 30%) + (Market × 20%)

Note: Baseline formulas adapt based on your company stage, customer segment, and data availability.

The formulas translate "Adoption signal is weak" into "Offering dimension needs Product + Engineering attention."

Signals tell you what's happening. Dimensions tell you who fixes it.

What you get: Dimension scores with team ownership

When we diagnose your PMF, you receive:

Five-dimension dashboard:

Customer: 7.7/10 🟡 Moderate — Product + Sales own it

Offering: 6.5/10 🟡 Moderate ← weakest — Product + Engineering own it

Story: 8.0/10 🟢 Strong — Marketing + Sales own it

Channel: 7.2/10 🟡 Moderate — Sales + Marketing + Partnerships own it

Company: 8.2/10 🟢 Strong — CEO + Leadership own it

For each dimension:

Signal breakdown (which signals contribute, and their scores)

Root causes (why this dimension is weak)

What would move it to 8/10 (specific actions)

3-6 prioritised recommendations (with impact, effort, expected PMF lift)

No more "everyone has a different theory about what's broken." Dimensions create a shared diagnosis with clear ownership.

We handle the signal tracking and formula complexity. You get actionable insights and tools to improve.

The five dimensions: Where PMF can weaken

1. Customer dimension

What it covers: Who you serve, ICP clarity, persona fit, and market segment.

When to focus here:

Symptoms: Win rates dropped, but you're not losing to specific competitors. Deals just don't close. Sales cycles are lengthening. Customers are churning because they're not the right fit. Revenue is growing, but from smaller, less valuable customers than your ICP.

Root cause: You're either serving the wrong segment, or your ICP's needs have evolved, and you haven't adapted. Often happens when sales compensate for weak demand by pursuing easier-to-close but wrong-fit customers. Short-term revenue boost, long-term retention disaster.

Example: Win rates dropped from 40% to 22%. Analysis shows you're closing SMB customers when your ICP is mid-market. Product works fine for mid-market (strong retention there), but SMB customers churn fast. Not a sales execution problem. Not a product problem. A targeting problem.

Common fixes:

Refine ICP definition with specificity (not "mid-market SaaS" but "head of security at 250-1’000 employee B2B SaaS companies using Palo Alto Networks")

Update targeting criteria and lead qualification

Align sales compensation to incentivise right-fit deals

Create negative personas (who not to pursue)

Team ownership: Product + Sales

2. Offering dimension

What it covers: What you deliver, problem-solution fit, feature value, product quality.

When to focus here:

Symptoms: Demos convert well, but customers struggle to see value after purchase. Usage drops after initial excitement. Churn is increasing despite strong demand. Customers cite "doesn't solve our problem" or "found a better alternative." Losing to competitors on specific features.

Root cause: Product doesn't solve the problem as well as customers expected. Either the core problem isn't urgent enough, or your solution doesn't deliver sustained value, or competitors have caught up on features.

Example: Strong demand (good pipeline, demos converting). Clear positioning. But retention is weak (18% churn, NRR at 95%). Product promises value customers want, but doesn't deliver sustained outcomes. Offering dimension issue.

Common fixes:

Improve onboarding to reduce time-to-value

Build features that deliver on the core promise

Eliminate friction between purchase and value delivery

Quantify and communicate business outcomes (not just features)

Team ownership: Product + Engineering

3. Story dimension

What it covers: How you communicate value, positioning, messaging, value proposition clarity.

When to focus here:

Symptoms: People know you exist, but don't understand differentiation. Long sales cycles despite a good product. Prospects say "we decided to wait" (urgency not established). Win rates are low, but the product works well for customers who adopt it. Customers get value but can't articulate it to others (weak referrals).

Root cause: Positioning doesn't resonate or doesn't establish urgency. Messaging is unclear, generic, or doesn't use customer language. Value proposition doesn't answer "why change, why now, why us."

Example: Product adoption and retention are strong (customers who use it love it). But demand is weak (long sales cycles, low win rates, difficulty getting meetings). Offering works. Positioning doesn't resonate or establish urgency. Story dimension issue.

Common fixes:

Reposition around outcome customers care about (not "AI legal assistant" but "Contract Lifecycle Management platform")

Use exact customer language in positioning

Establish urgency in messaging (why change now, cost of inaction)

Tighten the value proposition clarity

Team ownership: Marketing + Sales

4. Channel dimension

What it covers: How customers discover and buy, GTM motion, sales process, partner ecosystem.

When to focus here:

Symptoms: Product works (strong adoption and retention). Positioning resonates (good conversion once in conversation). But pipeline volume is too low, and it can't reach enough qualified buyers. Dependent on one channel (warm intros, single partnership). Sales cycles are long despite a strong product fit.

Root cause: Can't efficiently reach ideal customers. Channels are saturated or wrong. The buying process doesn't align with how customers prefer to purchase. High customer acquisition cost relative to alternatives.

Example: Retention is excellent. Positioning clear. But the pipeline is anaemic. Still dependent on warm introductions after 30 customers. Can't scale because no repeatable channel exists. Channel dimension issue, not product or messaging.

Common fixes:

Expand from warm introductions to outbound prospecting

Build partnerships with complementary vendors

Invest in SEO and content to create an inbound channel

Optimise the sales process to reduce friction

Layer on channel partnerships (resellers, integrations)

Team ownership: Sales + Marketing + Partnerships

5. Company Dimension

What it covers: Internal capability, team structure, processes, execution speed, organisational systems.

When to focus here:

Symptoms: Demand strong, positioning clear, product solves urgent problem. But customer satisfaction is declining because delivery is slow or support is inadequate. Onboarding takes too long. Support response times stretched. Team can't keep up with demand. Quality is declining as you scale.

Root cause: The Team can't deliver at the pace and quality the market requires. Internal capability bottleneck. Process inefficiency. Key person dependencies. Misalignment between teams.

Example: Good pipeline, high win rates, clear positioning, urgent problem. But implementation takes 12 weeks (the market expects 4). Support response times are 48 hours (market expects 4 hours). Customer satisfaction is declining despite product improvements. Company dimension issue—team can't execute at required pace and quality.

Common fixes:

Hire to eliminate capability gaps

Improve processes to increase execution speed

Automate routine workflows

Restructure teams to reduce dependencies

Build playbooks for repeatability

Team ownership: CEO + Leadership

Why dimensions map to team ownership

Dimensions create clarity because they map to how teams align:

Customer: Product defines ICP, Sales targets and qualifies

Offering: Product roadmaps, features, and Engineering builds

Story: Marketing crafts positioning, Sales delivers messaging

Channel: Sales executes GTM, Marketing generates demand, Partnerships expand reach

Company: CEO and Leadership build capability and align teams

When signals point to a specific dimension, teams know who needs to act. This reduces the "everyone has a different theory" problem and creates a shared understanding of where to focus.

Common diagnostic patterns

These patterns help you quickly identify which dimension needs attention:

🔍 Pattern 1: Win rates drop, but demo conversion stays strong

→ Story dimension. Messaging doesn't communicate differentiation clearly. Prospects are initially interested but don't convert when comparing alternatives.

🔍 Pattern 2: Strong adoption, weak retention

→ Offering or Customer dimension. Either product solves the initial problem but not the ongoing needs (Offering), or you're attracting the wrong ICP who outgrows the solution (Customer).

🔍 Pattern 3: Strong retention, weak demand

→ Story or Channel dimension. Product works for those who adopt, but positioning doesn't resonate (Story), or you can't reach enough qualified buyers (Channel).

🔍 Pattern 4: Growing customer base but declining average contract value

→ Customer dimension. Persona drifting to smaller, less valuable customers. Or Story dimension, not communicating value to higher-tier buyers.

🔍 Pattern 5: High churn across all customer segments

→ Company dimension. Experience or value delivery is an issue customers can't live with. The competitor does significantly better on execution.

The Experience Factor: Why customer experience matters for PMF

Most PMF frameworks focus on product features and market needs. We add a critical element: customer experience.

You can have the right ICP, the right product features, the right positioning, and the right channels. But if customers struggle to onboard, can't get help when stuck, or feel frustrated using your product, they won't renew. Retention signals will weaken, and PMF will erode.

Bad experience shows up in signals 3-6 months before it shows up in revenue:

January: Onboarding friction increases (customers taking 8 weeks to first value, from 4 weeks)

March: Usage frequency drops, feature adoption plateaus

May: Renewal conversations harder, customers stop referring

July: Churn spikes, NRR declines, revenue growth slows

Experience isn't separate from PMF. It's part of how fit manifests. This is why Company dimension matters not only for delivery and automation, but also for team capability, which in turn determines quality, which ultimately determines customer experience, which ultimately determines retention.

The experience-automation tension: As you scale (Stage 3-4), automation becomes essential for efficiency. But automation without intentional experience design creates friction. The solution is to automate the routine, preserve human touch-points where experience matters most.

Examples:

Automate: Data imports, account provisioning, billing, routine notifications, simple support queries

Preserve human: Complex onboarding steps, high-value customer check-ins, strategic account planning, complex support issues

What's Next: Putting it into practice

You now understand the 5 dimensions where PMF can weaken and how to diagnose which dimension needs attention.

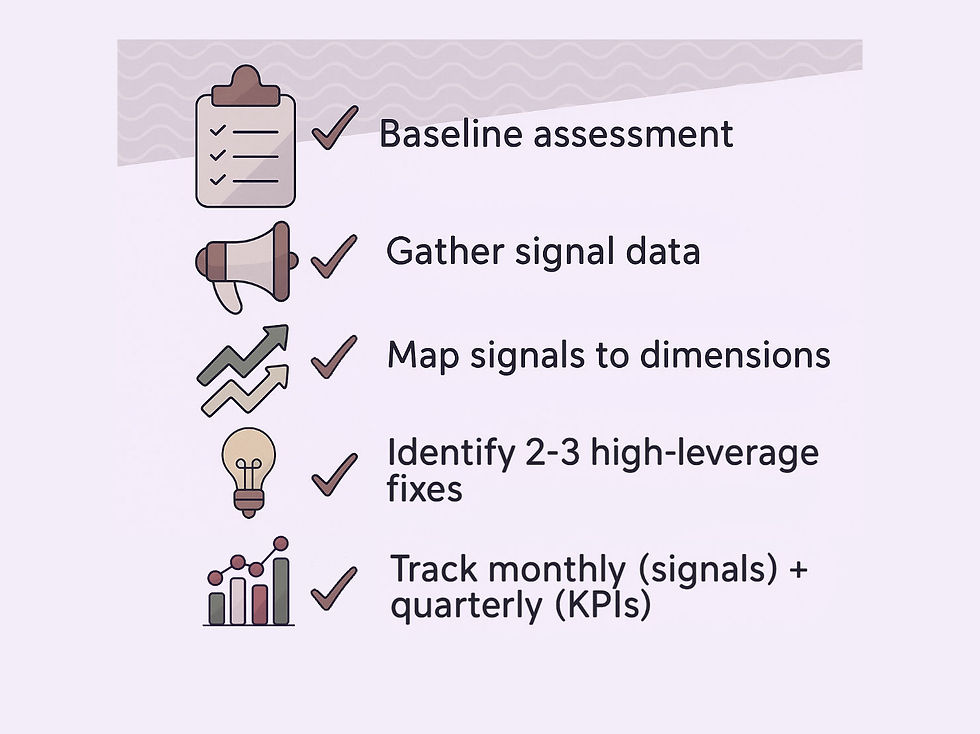

In Part 3 Implementation Guide, you'll read about:

How to run a self-assessment to identify your current stage and dimension strength

Which signals to track for your stage

How to build measurement systems that catch drift before it costs you

When to seek expert help vs. self-assess

Once you know which dimension is weak, Part 3 shows you how to track progress and prevent drift.

Or return to:

Part 1 How to Measure Product-Market Fit: Getting Started: Understand the 5 stages of PMF strength

Looking for an out-of-the-box system that works?

Get in touch to discuss your specific case and challenges.