How to Measure Product-Market Fit: Getting Started

- Chris Hug

- Oct 14, 2025

- 9 min read

Updated: Dec 10, 2025

How would you know if your product-market fit started weakening in January? Most companies won't find out until July or October, when it shows up in the revenue numbers. By then, you've burned six to nine months.

Product-market fit determines whether your company compounds growth or burns through capital chasing the wrong fixes. But most frameworks treat it as binary. You either have it, or you don't. That fails in practice.

This is the first of three related posts in our Complete Guide to Measuring Product-Market Fit.

Here, you'll see what product-market fit means, the five distinct stages from None to Saturating, and how to identify which stage you're at right now.

At-a-glance

The core problem:

Revenue is a lagging indicator: when ARR declines, PMF erosion starts 6-9 months earlier

Most companies only discover weak fit after burning budget on the wrong fixes

The five stages:

Stage 0: None (Searching) → Stage 1: Low (Early Traction) → Stage 2: Developing (Patterns Emerging) → Stage 3: Strong (Floodgates Opening) → Stage 4: Saturating (Market Penetration)

Reality check:

B2B PMF typically takes 18-36 months to reach a strong fit in an ideal world

You can move up or down, since PMF is dynamic and not permanent

The diagnostic question: How hard is it to find and serve your next customer?

This series:

Part 2 Diagnosing PMF: Understand the 5 dimensions for action and how signals map to them

Part 3 Implementation Guide: Get the self-assessment and tracking systems

Product-Market Fit is a team effort.

What product-market fit actually is

Product-market fit is the degree to which your offering solves a meaningful problem for a specific customer segment better than alternatives, in a way customers can understand, easily access, and apply.

Notice we don't talk about the word "achieve." That's intentional.

PMF isn't a milestone you hit once and move on. It's a position you hold and a position that shifts. Markets change. Customer priorities evolve. Competitors adapt. Your product-market fit six months ago isn't your fit today.

Some products find it quickly—Swiss e-signature company Skribble's founder credits deep customer empathy and deep understanding of daily workflows and the technology. Others pivot multiple times. Slack started as a gaming company before discovering its messaging tool was the real product. Notion's first version struggled until they rebuilt the experience entirely.

Most frameworks treat PMF as binary: you have it, or you don't. That model fails in practice.

Why binary thinking fails:

A company can have a strong fit with their ideal customer profile but weak positioning that makes value hard to communicate. Or clear messaging, but channel issues prevent discovery. Or strong adoption but weak retention because the offering doesn't deliver sustained value.

PMF is a system, not a single state. Tangible factors (product features, pricing, channel access) and intangible factors (positioning, customer perception, team capability) all interact. Change one element, and others shift in response.

That's why we measure PMF across five dimensions: Customer (who you serve), Offering (what you deliver), Story (how you communicate value), Channel (how customers discover and buy), and Company (how you deliver value and improve). Each dimension can be strong or weak independently.

When sales says "it's hard to sell this" and product says "our retention is fine," they're often both right. They're just looking at different dimensions of fit.

The Five Stages: Your position on the PMF ladder

PMF isn't binary, and it's not a vague spectrum. It progresses through distinct stages. More importantly, it's a two-way ladder – you can move up or down depending on market shifts, competitive moves, or your own execution.

For B2B companies, reaching strong PMF typically takes 18-36 months, but it can take years or never happen. Understanding which stage you're at helps you focus on what matters most right now.

Stage 0: None (searching)

What it feels like: You're testing hypotheses. Conversations with potential customers feel exploratory. You're not sure whether the problem is urgent enough, whether your solution resonates, or whether the market size justifies building.

Typical characteristics:

0-5 customers per product or service (mostly design partners or pilot users)

Each customer conversation teaches you something different

No clear pattern in who says "yes" vs. "no"

Product direction changes frequently based on feedback

Team under 10 people

What matters most: Validate that a specific persona faces an urgent problem they'll pay to solve. Conduct 20-30 customer interviews before writing code. Ask: Do they face this problem? How acute is it? How do they solve it today? How much do they spend solving it?

Moving up: Find 3-5 customers who genuinely need what you're building and are willing to pay for it (not just "interested"). Develop a credible argument for how the business could eventually scale efficiently.

Yellow flags:

Can't get people to meet about the problem → likely not mission-critical

Every conversation reveals completely different needs → problem not focused enough

"Interested" but won't commit to pilot or pay → problem not urgent

Stage 1: Low PMF (early traction)

What it feels like: You've landed the first customers, but each one feels like the last customer you'll ever find. Finding the next one requires significant effort. Product customisation requests vary widely between customers.

Typical characteristics:

5-15 customers

CHF 50K-500K ARR

Mostly warm introductions (friends, investors, network)

Sales conversion: 1 in 10-20 warm intros converts

Each customer has slightly different needs

No renewals yet (too early)

Team under 15 people

What matters most: Satisfaction above all. Build something 3-5 customers genuinely need—they can't live without it. At this stage, inefficiency is expected. Spend disproportionate time making early customers successful.

Example of what "good" looks like: All customers using the product at least weekly. Two customers have onboarded multiple internal users. Getting positive feedback when asked directly. Customer onboarding can feel lengthy (8+ weeks), but that's acceptable at this stage.

Moving up: Get to the point where 40% of users would be "very disappointed" without your product. Increase usage frequency and number of users per customer. Find 2-3 more customers to test if patterns emerge.

Yellow flags:

Usage is low and not growing over 3-6 months → offering doesn't solve the problem well enough

Design partners are hesitant to convert to paid → value perception is weak

Each customer wants fundamentally different features → consulting business, not product business

Stage 2: Developing PMF (patterns emerging)

What it feels like: Repeatability starts to appear. You're seeing patterns in who converts, what messaging resonates, and which features drive value. But acquisition still requires significant effort.

Typical characteristics:

10-30 customers

CHF 500K-2M ARR

Early signs of scalable channels (not just warm intros)

First-call to closed-won approaching 10%

Some renewals tracked; 10-20% regretted churn acceptable

Average sales cycle shortening (e.g., was 47 days, now 32 days)

Gross margin at least 50%

Burn multiple under 5X

Team: 10-25 people

What matters most: Demand. You've proven customers get value (satisfaction). Now prove you can find more of them repeatably. Focus on scalable channels (outbound, SEO, partnerships, referrals) and positioning that resonates consistently.

Example of what "good" looks like: Most recent 5 customers paying 2x what early customers paid (increasing ACV). Four customers renewed successfully. Weekly active usage is increasing. Fewer customisation requests per customer—you're selling the same product more consistently.

Moving up: Find 1-2 scalable demand channels. Re-evaluate and focus the ICP definition. Track which prospects convert fastest and why, and do more of that.

Yellow flags:

Current customers are happy, but can't repeat the process → channel or positioning issue

Regretted churn above 20% → solving initial problem, but not ongoing needs

Sales cycles lengthening, losing deals late → offering doesn't quite fit, or Story doesn't establish urgency

Struggling to hit target price point → nice-to-have vs. must-have perception

Stage 3: Strong PMF (floodgates opening)

What it feels like: The boulder shifts from pushing uphill to chasing it downhill. Demand increases noticeably. Inbound arrives without direct effort. People have heard of you. You know precisely who your customer is, and finding them becomes systematically easier. Often, new ICPs emerge and work.

Typical characteristics:

50-150+ customers

CHF 2M-15M+ ARR

Multiple channels working (inbound + outbound)

10%+ of demand from referrals and word of mouth

First-call to closed-won: 10-15%

Net revenue retention above 110%

Regretted churn under 5%

Gross margin 60-70%+

Burn multiple 1-3x

Team: 30-100+ people

What matters most: Efficiency and automation. Demand and satisfaction are established. Now drive efficiency through automation and process optimisation. Finding customers (CAC), selling them (conversion, CAC payback under 18 months), activating them (automated onboarding flows), supporting them (self-service + automation), producing the product (COGS, gross margin 75%+). The goal: maintain customer experience quality while reducing manual effort.

Example of what "good" looks like: Closed 88 customers, CHF 10M ARR, projecting 3x growth next 12 months. Inbound channels are increasing. 108% NRR, 4% regretted churn. 71% gross margin (was 65%). Onboarding is 60% faster than last year.

Moving up: Build efficient GTM motion. Layer on channel partnerships. Figure out broad awareness building. Don't sacrifice growth for efficiency or efficiency for growth. Balance both simultaneously. Develop a model and signal-driven planning to know which investments pay off.

Yellow flags:

Real competitors emerge → offering gap may be closing

Caught between investor pressure to lower burn and fear that cutting spend stops growth → need efficiency improvements

Referrals plateauing → satisfaction or advocacy weakening

Growth slowing (was 3x prior two years, struggling to hit 2x this year) → market saturation in current ICP or positioning staling

Found first scalable channel, but it's saturating, struggling to find next one → channel dependency risk.

Stage 4: Saturating PMF (market penetration)

What it feels like: You're the default choice in your category. Brand recognition makes customer acquisition dramatically easier. "Vanta for SOC 2" or "Skribble for qualified e-signatures in Switzerland"—you're becoming synonymous with the solution.

Typical characteristics:

250+ customers

CHF 15M+ ARR

2+ scalable demand channels humming

First-call to closed-won above 15%

Net revenue retention above 120%

Regretted churn under 5%

Gross margin 80%+

Burn multiple 0-2x (profitable or near-profitable growth)

Team: 100+ people

What matters most: Expanding TAM. You've captured a significant share of your initial target market. To compound growth, you need to find PMF again in new markets and segments. Consider: new product use cases (add features/functionality), new products for the same buyers, same product for new market segments, same product for different buyers.

Example of what "good" looks like: CHF 30M ARR, 562 customers, 24% sales conversion, CHF 112K ACV. Grew 3x last 12 months, projecting 2x next 12 months with high confidence. 123% NRR, 3% regretted churn. 86% gross margin, 11-month CAC payback. Sales, onboarding, and customer success teams running on repeatable playbooks. Getting 2-3 positive customer emails weekly, unprompted.

Moving forward: Expand into adjacent markets and segments or introduce new products, services, or features. Build partnerships. Expect to move back through lower PMF stages with each expansion—that's normal. Each new market or product requires finding fit again.

Yellow flags:

Growth slowing despite market still growing → captured most addressable customers in current positioning

New customer acquisition cost rising → market awareness saturated, need new positioning or market

Competitors entering with different positioning → category evolving, may need repositioning

Product roadmap driven by feature requests from adjacent segments → considering expansion, but not systematic about it

When PMF weakens: Recognising the decline pattern

PMF can weaken at any stage. A company at Stage 3 (Strong) can enter decline. A company at Stage 2 (Developing) can see fit erode. Decline is a state change, not a stage.

The pattern is consistent across stages:

What it feels like: Metrics plateau or decline despite sustained effort. Competitive pressure intensifies. Customers express increasing objections. Messages that resonated last year don't land anymore. Win rates drop. Renewal conversations get harder.

Common signals across stages:

Revenue growth slowing (was 50%, now 10%)

Win rates declining (was 30%, now 18%)

Sales cycles lengthening

Churn increasing (was 8%, now 15%)

Competitive losses rising

Burn multiple rising despite revenue growth

Customer feedback shifting ("doesn't solve our problem anymore," "found a better alternative," "priorities changed")

What causes decline:

Decline happens when one or more of the five dimensions weaken:

Customer dimension: ICP's needs evolved, or you drifted to the wrong segment

Offering dimension: Competitors caught up, or the customer's situation changed

Story dimension: Category narrative shifted, your positioning no longer resonates

Channel dimension: Acquisition channels saturated or disrupted

Company dimension: The Team can't execute at the pace the market requires

The path back:

Treat declining PMF like Stage 1 again. Revalidate problem-solution fit. Talk to 20-30 customers to understand what changed. You'll likely need to adjust one or more of the following dimensions: Persona, Problem, Promise, Product.

Declining PMF is recoverable, but requires decisive action. Small tweaks rarely work.

The key insight: PMF is a dynamic state, not a permanent one. Markets shift. Competitors adapt. Customer needs evolve. A strong fit today can become a weak fit in 12-18 months without continuous measurement and adjustment.

Diagnostic question to gauge whether you're entering a decline: Is finding and serving your next customer getting harder, not easier?

What's next: Measuring PMF month-to-month

Understanding which level you're at is essential, but how do you actually measure PMF month-to-month before revenue declines?

In Part 2 Diagnosing PMF, you'll see:

The 5 dimensions that translate signals into action and show which team owns each fix

How our PMF System maps signals to dimensions so you know where to act

Why measuring across dimensions catches drift 6-9 months before it hits revenue

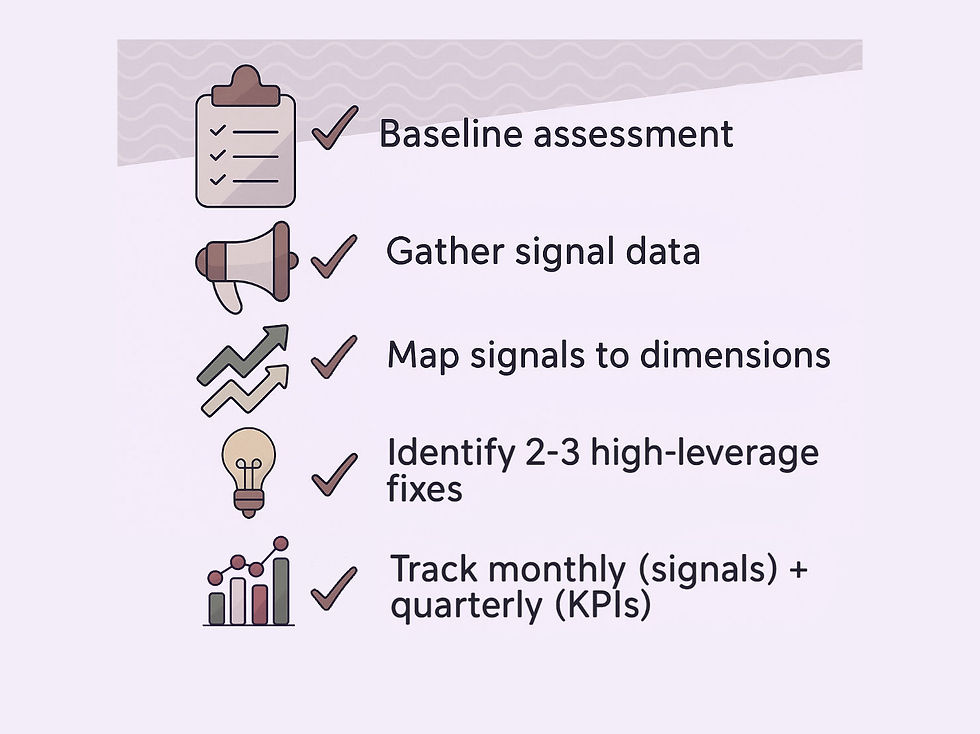

Once you understand the dimensions, Part 3: Implementation Guide helps you:

Run a self-assessment to identify your current stage and dimension strength

Start tracking the signals that matter for your stage

Build measurement systems to catch drift before it costs you

Looking for an out-of-the-box system that works?

Get in touch to discuss your specific case and challenges.