Acceleration Guide: The Four Phases from Idea to Product-Market Fit

- Chris Hug

- Dec 1, 2025

- 10 min read

You ask yourself how long it takes to reach product-market fit. You've heard the success stories of Slack pivoting from gaming to messaging and Notion rebuilding from scratch, and you estimate it will take six months. Maybe nine if things get complicated.

The reality is that most B2B companies take much longer. Not because founders work slowly. Because finding product-market fit requires navigating complexity and often pivoting, that isn't obvious from the outside.

This acceleration guide was part of our product-market fit program as coaches for the HSG Start Accelerator Batch 1 startups (learn more).

At-a-glance

The Four Phases:

Phase 1: Validate — Confirm the problem is urgent enough to solve

Phase 2: Prove Value — Demonstrate your solution works for initial customers

Phase 3: Find Patterns — Discover repeatability in who converts and why

Phase 4: Scale Systems — Grow with repeatable acquisition and delivery

The complexity challenge:

Each phase has hidden complexity that founders underestimate

Most failures happen because teams optimise the wrong things at the wrong time

Pattern recognition across 20-30 conversations requires structured analysis, not gut feel

Traditional approaches can take 24-36 months; systematic frameworks compress this significantly

How we help:

Structured validation frameworks catch problem-solution misalignment in weeks, not months

Evidence-based scoring prevents "friendly feedback" from masking real issues

Pattern recognition across personas reveals who to target (and who to avoid)

Customer-centric diagnostic tools identify drift before it damages revenue

Related reading:

How to Measure Product-Market Fit: Getting Started — Understand the 5 stages of PMF strength

From scattered use cases to €550k seed — Early-stage positioning example

Implementation Guide — Self-assessment and tracking systems

The navigation challenge

You need to validate problems across personas. Identify patterns in who converts and why. Recognise when you're attracting wrong-fit customers before they damage retention. Distinguish between execution issues and positioning gaps. Know when to pivot and when to persist.

The companies that reach strong PMF faster don't skip steps. They have frameworks that systematically handle the complexity.

This guide shows you the four phases from hypothesis to systematic growth, what each phase actually requires, where founders typically get stuck, and how systematic frameworks accelerate the process.

Phase 1: Validate (before building)

Objective: Confirm that a specific persona faces an urgent problem they're willing to pay to solve

PMF Stage: Stage 0 (None | Searching)

What this actually requires

Problem validation isn't just talking to potential customers. It's structured evidence collection:

Persona hypothesis development: Who specifically has this problem? Not "mid-market companies" but "Head of Security at 250-1,000 employee SaaS companies using legacy VPN infrastructure."

Problem urgency assessment: On a 1-10 scale, how acute is this pain point? What makes it that severe? What business outcomes does it impact? Not everyone who has a problem will pay to solve it.

Alternative analysis from buyer perspective: How do they solve it today? What do they spend (money, time, effort)? Why don't current solutions work? Reveals whether there's an actual gap or just a mild inconvenience.

Pattern recognition across 20-30 conversations: Five conversations show individual opinions. Twenty reveal patterns. Thirty gives confidence to make Go/Pivot/Stop decisions.

Commitment signals vs. politeness: "Would you use this?" gets polite yeses. "Will you be a design partner when we build it?" reveals real commitment.

Founder and innovator pitfalls

❌ Building before validating: Six weeks developing features, then discovering the problem isn't urgent. Reversing this sequence saves months.

❌ Pitching instead of listening: Founders explain their solution before understanding the customer's world. You learn less. Customers give politeness, not truth.

❌ Friendly feedback masking reality: Friends and former colleagues will be encouraging. You need brutal honesty from people who would actually buy.

❌ Stopping after 5-10 conversations: Not enough volume for pattern recognition. Individual opinions feel like insights but often mislead.

❌ Treating all "yes" responses equally: Not all problems are urgent enough to pay for. Not all personas have budget authority. Validation requires separating interest from commitment.

How we accelerate this phase

Problem-Offering Validation Framework:

Structured hypothesis testing (problem, persona, urgency, alternatives)

Evidence-based scoring prevents confirmation bias

Go/Pivot/Stop decision gates with clear criteria

Catches misalignment in 2-3 weeks instead of months of building

Persona Research Tools:

Unbiased research synthesis across sources

Pattern recognition across conversations

Voice-of-customer language extraction

ICP definition with disqualifiers (who looks like a fit but isn't)

Also makes customer discussions more targeted and meaningful

Alternative Analysis:

Buyer perspective competitive mapping

Switching cost identification

Gap analysis (where alternatives fail)

Opportunity sizing based on real alternatives, not assumptions

The result: You know whether to build, pivot, or stop. Decide with evidence, not gut feel, before investing months in development.

Phase 2: Prove value (initial traction)

Objective: Build the simplest version that demonstrates your solution works for 3-5 design partners

PMF Stage: Stage 0 → Stage 1 (None to Low | Early Traction)

What this actually requires

Getting 3-5 customers to see value isn't just about building fast. It's about proving your hypothesis with real usage:

Minimum viable feature set: What's the smallest thing that solves the core problem? Not comprehensive. Not polished. But indispensable. Identifying this requires understanding what delivers value vs. what looks impressive.

Design partner selection: Not just anyone who'll try it. Customers who match your ICP hypothesis, have an urgent problem, and will give honest feedback when it doesn't work.

Usage pattern tracking: Are they using it weekly? Hitting value milestones? Which features drive retention vs. initial excitement? Manual tracking at this stage, but rigorous.

Value delivery measurement: Would they be "very disappointed" without it? (Sean Ellis test). Are they willing to pay once the prototype proves value? Free users behave differently from paying customers.

Rapid iteration based on real behaviour: Not feature requests, but usage patterns. When customers say they love Feature X but only use Feature Y, behaviour reveals the truth.

Founder and innovator pitfalls

❌ Building too much too fast: Adding features before validating core value. Complexity increases. Learning slows. Each new feature that’s not core adds noise.

❌ Confusing interest with real usage: Design partners who try it once aren't getting value. Weekly usage signals that the product solved a real problem.

❌ Scaling processes prematurely: Automation and self-service can wait. Manual onboarding and hands-on support are expected at this stage. Inefficiency, but faster learning.

❌ Rationalising negative feedback: "They just don't understand it yet" or "They're not the right persona." Sometimes true. Often avoidance. If multiple design partners struggle, that's a signal.

❌ Not converting to paid early enough: Keeping everyone on free design partner terms too long. Paying customers reveal different objections and value perception than free users.

How we accelerate this phase

Strategic Positioning Framework:

Core differentiation extraction (what you do that others can't)

Positioning structure for early customer conversations

Modest and bold positioning versions for different contexts

UVP development with segment-specific proof points

Customer Intelligence Tools:

ICP pattern extraction from early conversations

Behaviour tracking (what they do vs. what they say)

Value milestone definition

Design partner-to-customer conversion guidance

Narrative Development:

Customer-facing stories that show success

Voice-of-customer language for early pitches

Objection handling based on real feedback patterns

The result: You prove value with 3-5 customers and know whether to progress, to move, or to pivot before investing further.

Phase 3: Find patterns (discovering repeatability)

Objective: Scale from 5 to 20-30 customers, discovering what's repeatable about who converts and why

PMF Stage: Stage 1 → Stage 2 (Low to Developing | Patterns Emerging)

What this actually requires

Scaling to 30 customers isn't just doing more outreach. It's systematic pattern recognition:

Multi-channel experimentation: Testing whether customers come from outbound, content, partnerships, or referrals. Not all channels produce customers who stay. Some attract wrong-fit prospects who churn fast.

Conversion pattern analysis: Which prospects convert? What do they have in common? Which objections keep appearing? What messaging resonates vs. what falls flat? Requires structured tracking, not memory.

Customer cohort comparison: Do customers acquired through Channel A behave differently from Channel B customers? Do they retain at different rates? Expand differently? Require different onboarding?

ICP tightening based on who gets value fastest: Not just "who will buy" but "who gets value, stays, and expands." Early customers willing to pay but who churn quickly do more harm than good.

Standardising what works, eliminating what doesn't: Productizing custom solutions multiple customers need. Saying no to one-off requests that don't fit the pattern. Remove features when no one is using them, even if they are already built. It’s hard when revenue is scarce, but more in this case is usually not better.

Retention and NPS measurement: Who renews? Who churns? Why? Would users be "very disappointed" without your product? Cohort analysis reveals whether recent customers behave better or worse than early ones.

Founder and innovator pitfalls

❌ Chasing any deal instead of right-fit deals: Revenue feels validating, but wrong customers churn fast and refer other wrong customers or worse, put off good customers. Negative flywheel.

❌ Saying yes to every feature request: You'll build 20 different products. Patterns mean customers want similar problems solved similarly.

❌ Staying dependent on warm introductions past 20 customers: If you can't find customers through scalable channels, you can't scale the business.

❌ Ignoring why deals don't close: Win rates declining? Sales cycles lengthening? Leaders assume it's execution. Often, it's the positioning or offering fit that weakens.

❌ Premature scaling: Hiring sales reps before repeatability exists. They thrash because there's no playbook yet. Burn increases without revenue growth.

How we accelerate this phase

Target Sweet Spot (Visual Mapping):

Multi-segment evaluation and prioritisation

Opportunity sizing with strategic fit assessment

Dependency identification (Segment B requires proof from Segment A first)

Entry barrier analysis per segment

Pattern Recognition Across Indicators:

Win/loss pattern analysis

Persona fit tracking (who converts vs. who gets value)

Channel performance comparison

Cohort retention analysis

Offering Refinement:

Feature prioritisation based on usage patterns

Onboarding standardization

Custom-to-product decisioning

Packaging guidance for emerging segments

Execution Deliverables:

Positioning statements (modest and bold versions)

Pitch outlines with segment-specific proof points

Messaging frameworks using voice-of-customer language

Objection handling grounded in real patterns

The result: You know who to target, how to reach them, and what messaging works—with evidence, not assumptions.

Phase 4: Systematic growth (scale systems)

Objective: Grow from 30 to 100+ customers with repeatable acquisition and delivery systems

PMF Stage: Stage 2 → Stage 3 (Developing to Strong | Floodgates Opening)

What this actually requires

Scaling to 100+ customers isn't just doing more of what worked at 30. It's building systems that work without founder involvement:

Multi-channel demand generation: Inbound (SEO, content, case studies), outbound (cold outreach with repeatable scripts), partnerships (channel partners, integrations), referrals (systematic programs, not ad hoc). Each channel requires different systems.

Sales playbook development: Documented discovery questions, demo flows, objection handling, and competitive battle-cards. What works can't live in the founder's or the leader's heads anymore. It needs to be transferred to the sales team.

Onboarding automation without quality loss: Guided setup, interactive tutorials, automated provisioning. But preserving human touch-points where experience matters. Over-automation tanks satisfaction.

Customer success runbooks: Engagement cadence, expansion triggers, health scoring, renewal processes. Proactive outreach before problems become churn.

Efficiency metric tracking: CAC, CAC payback period, LTV/CAC ratio, gross margin, burn multiple. Monthly monitoring catches drift before it damages unit economics.

PMF signal monitoring: Adoption, retention, demand, persona fit, competitive pressure. Leading indicators predict revenue outcomes 6-9 months early. Catch weakening before it hits ARR.

Founder and innovator pitfalls

❌ Growth requires constantly increasing spend: Burn multiple rising means you're risking buying growth rather than earning it. It can signal weak product-market fit or inefficient channels.

❌ Team struggling to keep up with demand: Quality declining (onboarding degrading, support response times lengthening, product bugs increasing). Growth outpacing internal capability.

❌ Over-automation removing all human touch-points: Automation is essential, but customers still need humans at key moments. Balance can be hard to find.

❌ Losing sight of core ICP: Chasing adjacent segments before mastering core ICP. Expansion is good, but premature expansion creates complexity without proportional revenue.

❌ Assuming PMF is permanent: Markets shift. Competitors adapt. A strong fit today can weaken in 12-18 months without monitoring. Continued measurement isn't optional.

How we accelerate this phase

Eight Leading Indicator Tracking:

Adoption signals (time-to-value, activation rate, usage frequency)

Retention signals (renewal patterns, NRR, usage over time)

Demand signals (win rates, pipeline velocity, sales cycle length)

Value & proof signals (expansion revenue, referrals, advocacy)

Persona fit signals (retention by segment, velocity differences)

Competitive pressure signals (win/loss patterns, pricing pressure)

Market attractiveness signals (TAM growth, category readiness)

Risk severity signals (concentration risk, dependencies)

Diagnostic System Integration:

Pattern recognition across all eight indicators

Causal chain identification (January adoption weakness → July ARR decline)

Dimension diagnosis (Customer, Offering, Story, Channel, Company)

Prioritised recommendations with clear ownership

Execution Plan Development:

Winning Offering Plan (Product + Engineering ownership)

Market Advantage Plan (Sales + Marketing + Partnerships ownership)

Task databases with timelines and milestones

Progress tracking against diagnostic insights

The result: You scale predictably with systems that catch drift early. Before it costs you quarters of growth.

The reality: Traditional approaches are slow

Systematic frameworks accelerate. Most founders and leaders navigate these phases through trial and error. Build, test, learn, adjust. Six months become twelve. Twelve becomes twenty-four.

The companies that reach strong PMF faster use frameworks that:

Validate problems with structured evidence collection, not friendly conversations

Recognise patterns across 20-30 conversations systematically, not through gut feel

Identify which personas get value fastest based on data, not assumptions

Track leading indicators that predict outcomes months before revenue metrics shift

Diagnose dimension weakness early (Customer, Offering, Story, Channel, Company)

Generate actionable recommendations with clear ownership

This is the complexity we built our PMF system to handle. You don't build the validation frameworks. You don't map indicator patterns to diagnostic insights. You don't create evidence scoring systems.

We do that for you.

The four product market fit phases in our system

Phase 1: Validate

Problem-Offering Validation Framework delivers Go/Pivot/Stop decisions in 2-3 weeks

Persona research tools extract patterns across conversations

Alternative analysis from the buyer's perspective

Evidence-based scoring prevents friendly feedback from misleading

Phase 2: Prove Value

Strategic positioning development (modest and bold versions)

Customer intelligence tools track real usage vs. stated interest

Narrative development using voice-of-customer language

Design partner-to-customer conversion guidance

Phase 3: Find Patterns

Target Sweet Spot visual mapping prioritises segments with dependencies

Pattern recognition across win/loss, personas, channels, and cohorts

Offering refinement based on usage data

Execution deliverables: positioning, pitch outlines, messaging frameworks

Phase 4: Scale Systems

Eight leading indicator tracking predicts outcomes 6-9 months early

Diagnostic system identifies dimension weakness (Customer, Offering, Story, Channel, Company)

Execution plans with clear ownership (Product, Sales, Marketing, Leadership)

Offering Spectrum and House methodology to build the right business model

Monthly monitoring catches drift before it damages revenue

The difference: Systematic frameworks compress what traditionally takes 24-36 months into a faster, more confident path to strong product-market fit.

What's next

Understanding the phases helps you know what's required at each stage. But navigating them requires frameworks that systematically handle their complexity.

In How to Measure Product-Market Fit: Getting Started, you'll see:

The 5 stages of PMF strength (None → Low → Developing → Strong → Saturating)

How to identify which stage you're at right now

What to focus on at each stage

Once you understand your stage, Part 2: Diagnosing PMF shows you:

The 5 dimensions where fit can weaken (Customer, Offering, Story, Channel, Company)

How to diagnose which dimension needs attention

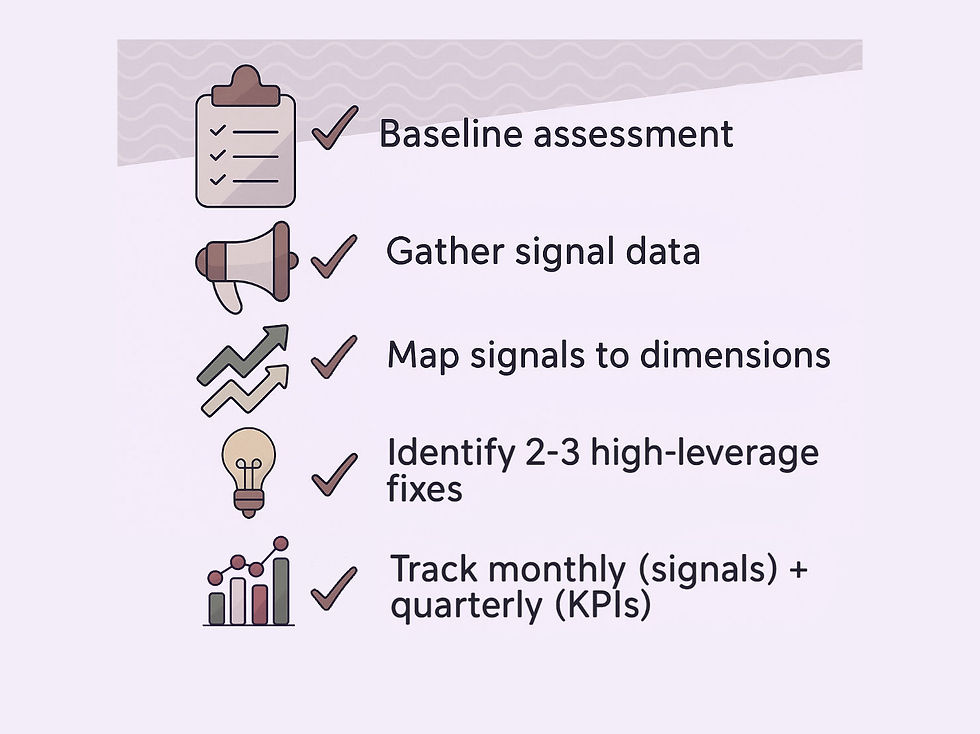

And Part 3: Implementation Guide gives you:

Self-assessment to identify your stage and dimension strength

Tracking systems to catch drift before it costs you

Or see how we helped an early-stage startup go from scattered positioning to €550k seed round in three months.

Ready to accelerate your path to product-market fit?

We work with early-stage founders to established business to validate problems, prove value, and identify patterns faster than trial-and-error allows for new technology ventures.